We are sometimes interested in how the economy evolves over time in response to a change in the environment. This change could either be transitory or permanent. Here we will consider a transitory change in aggregate TFP. We assume that this change in TFP was unanticipated but after it occurs the dynamics of TFP are known perfectly. We call this a perfect-foresight transition or MIT shock.

Suppose that the economy is subject to a transitory aggregate shock that was previously viewed as a zero-probability event. Going forward, there is no uncertainty over the dynamics of the shock or other aggregate variables, but there can be uncertainty over the idiosyncratic variables.

Let's extend our discussion of the Aiyagari economy with a productivity shock . So now

Suppose in steady state and was expected to remain there when news arrives at that will follow a path . Here we will assume this path is a temporary deviation from steady state so as grows large returns to its steady state value.

Our goal is to compute the path for . To do so, we pick a length of the transition and we will assume that the economy is back in the stationary equilibrium at . Using the production function and firm first-order conditions we can determine from . So the problem is to find an equilibrium path .

To start, we will use an algorithm that reflects the one we used for the stationary equilibrium of the Aiyagari economy: we guess , solve the household's problem, simulate the distribution of wealth, and then check market clearing. The difference here is that there is a time dimension to everything.

Given the guess , we compute the return on capital and wage at each date from the firm's first-order condition. We then solve the household's problem backwards in time taking these prices as given. We can again use the endogenous grid method but now we need to specify which time period the prices and policy rules correspond to.

Like before, suppose the consumer has labor endowment at date and saves an amount . The the savings first-order condition can be written as

where the subscript indicates that is the marginal value of assets at date . Given we can compute the right-hand side and solve this equation for . Next we use the budget constraint to solve for the savings policy rule . We now have a mapping from to in period which is the policy rule . We begin these steps in using the steady state envelope condition as . We then iterate backwards in time to arrive at .

Once we have the policy rules, we simulate the distribution of wealth forwards through time. That is, entering date , the distribution of wealth is the steady state distribution. We then update this with the policy rules from date . Let be the non-stochastic simulation transition matrix using the saving policy rule . Let be the steady state distribution. We then set and for .

We can now compare the capital stock implied by the distribution of wealth

where is the distribution approximated by . Our goal is that , where is our guess. If that's not the case we need to adjust our guess. The difficult part of the algorithm is how to update the guess so as to move towards market clearing. A simple alogithm tends to work in this example: make the new guess a convex combination of the previous guess and . Suppose in iteration we guess and the implied capital supply is . We then set

for some step size .

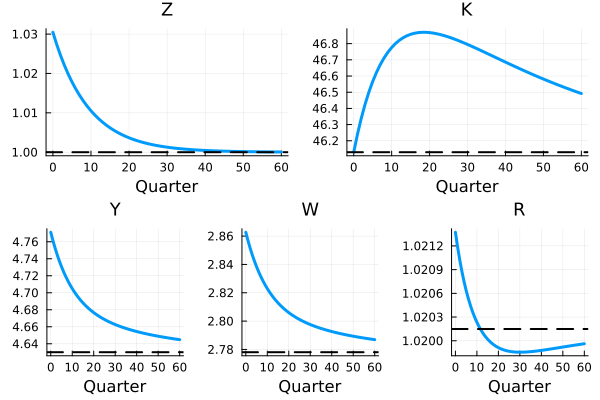

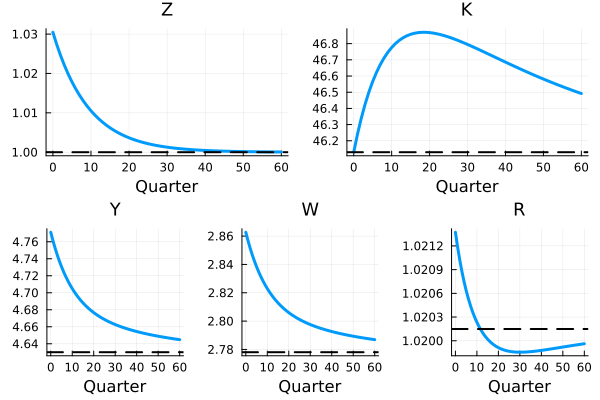

See MIT.jl for an application where we simulate a 3% positive TFP shock. The transition path should look like the figure below.

The algorithm above can be expressed as a single non-linear equation that takes the vectors and as arguments and sets to zero. The algorithm then can be interpreted as solving this non-linear equation using a version of Newton's method in which we guess the Jacobian of with respect to is where Is the identity matrix. When solving the equation non-linearly, using the wrong Jacobian is not a problem provided that we find a solution (the Jacobian is only a means of moving towards a solution). However, when we work with richer models, a simple guess of approximate Jacobians typically don't work because there are too many interdependencies between variables and across time periods. This leads us to the issue of how to compute the Jacobian of when includes equations that depend on the aggregate behavior of a group of heterogeneous agents. We discuss that next.